Recent Changes Related GST Returns and Revocation of Cancellation

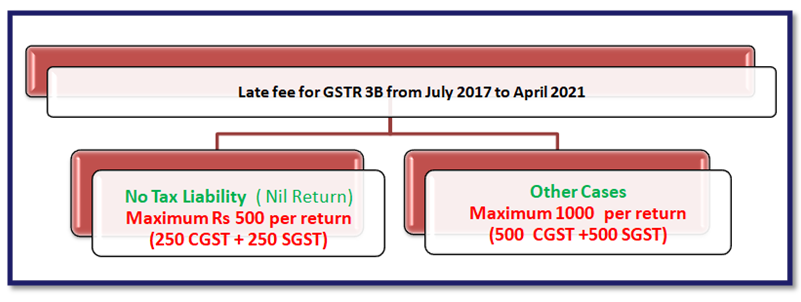

1. GST AMNESTY SCHEME EXTENSION

In the 43rd GST Council Meeting, Amnesty Scheme was introduced to provide relief to taxpayers regarding late fees for pending Returns.

• The Last Date to avail of this benefit has been extended from 31st August 2021 to 30th November 2021. ( Vide Notification No.33/2021 dated 29th August 2021).

2. REVOCATION OF CANCELLATION OF GST REGISTRATION

• If time limit for application for revocation of cancellation of GST registration falls between 01.03.2020to 31.08.2021, the time limit for making such application has been extended to 30th September 2021. ( Vide Notification No.34/2021 dated 29th August 2021).

• This is applicable for registrations cancelled by the proper officer for non-filing of returns for 3 consecutive tax periods in case of composition tax payers and for continuous period of 6 months in case of other tax payers ( Section 29(2), Clauses b and c ).

3. IMPLEMENTATION OF RULE 59(6)

This rule was introduced on 1st Jan 2021 vide notification No.1 /2021 and this has been implemented in GST network w.e.f 1st Sept 2021. The rule is summarized below.

a) For Monthly Filers– GSTR 3B for the previous 2-Month Tax Period is not filed.

OR

b) For Quarterly Filers – GSTR 3B for the previous Quarter is not filed.

The portal will restrict the filing of GSTR 1/IFF till the time the GSTR 3B returns are filed

So in case, it is found that the GSTR-3B return has not been filed in time the system will restrict further processes relating to filing of GSTR-1/IFF and will not allow proceeding till the conditions of Rule-59(6) are complied with. The facility to file would get restored on successful filing of GSTR 3B and no separate approval would be required.

We are a well-established GST Consultant in Kochi, with experience in accounting and taxation, and we can help you with the proper GST assistance.

Contact us at vbvassoc@gmail.com or call us at +91 980 901 2123 for further assistance.

English

English