Significant Decisions Taken in the 45th GST Council Meeting

GST LAW AND PROCEDURE

Measures for Trade facilitation: The following laudable changes have been recommended with a view to ease certain long-standing hurdles.

1. If ineligible input credit has been availed by the taxpayer, interest is to be paid only if the ITC has been availed and utilized for payment of taxes and this amendment shall be given retrospective effect from 1st July 2017. The interest rate applicable shall be 18%.

For giving effect of this much-needed requirement from the trade Section 50(3) shall be amended retrospectively.

2. If there is any unutilized balance in the CGST and IGST cash ledger then it can be to be transferred between distinct persons (entities having the same PAN but registered in different states). So, the present refund procedure need not be followed in such cases.

3. Where tax has been paid under the wrong head (CGST and SGT paid instead of IGST wrongly considering the supply as intrastate or vice versa), the procedure has been prescribed under the CGST rules as specified in section 77(1) of the CGST/SGST Act and section 19(1) of the IGST Act. The council has recommended inserting provisions for removing ambiguity regarding procedure and time limit for filing refund of tax wrongfully paid.

4. Issuance of the following circulars in order to remove ambiguity and legal disputes on various issues, thus benefiting taxpayers at large:

a. Clarification on the scope of “intermediary services”; – Seeks to address the question of including this as export of services.

b. A person incorporated in India under the Companies Act, 2013 and a person incorporated under the laws of any other country are to be treated as separate legal entities and would not be barred by the condition (v) of the sub-section (6) of section 2 of the IGST Act 2017 for considering a supply of service as export of services;

c. Clarification in respect of certain GST related issues:

i. W.e.f. 01.01.2021, the date of issuance of debit note (and not the date of underlying invoice) shall determine the relevant financial year for the purpose of section 16(4) of CGST Act, 2017.

A very welcome step for ensuring that input credit is not denied because the financial year pertaining to which a debit note is raised and consequently the date of filing annual return has expired. The measure of delinking of debit notes with original invoice would now be given full beneficial effect to the taxpayer.

ii. There is no need to carry the physical copy of tax invoice in cases where an E-invoice has been generated by the supplier.

Applicable in the case of those categories of suppliers who are required to generate invoices through IRP.

iii. Only those goods which are actually subjected to export duty i.e., on which some export duty has to be paid at the time of export, will be covered under the restriction imposed under section 54(3) of CGST Act, 2017 from availment of refund of accumulated ITC.

Measures for streamlining compliances in GST

1. Aadhaar authentication of registration to be made mandatory for being eligible for filing refund claim and application for revocation of cancellation of

2. Late fee for delayed filing of FORM GSTR-1 to be auto-populated and collected in next open return in FORM GSTR-3B.

Currently, this amount is not appearing in the GSTR 3B returns.

3. Refund to be disbursed in the bank account, which is linked with the same PAN on which registration has been obtained under

4. With effect from 01.01.2022 a registered person shall not be allowed to furnish FORM GSTR-1 if he has not furnished the return in FORM GSTR- 3B for the preceding month.

Currently, this restriction is 2 months w.e.f 1st Sep 2021; this is recommended to be made more stringent. Delay in filing 3B returns even for a month will disable registered persons from filing GSTR 1 of outward supplies and consequently, the recipient would not be able to fetch this input in his GSTR 2B returns.

5. The ITC in respect of invoices/ debit notes, to be restricted to the extent the details of such invoices/ debit notes are furnished by the supplier in FORM GSTR-1/ IFF and are communicated to the registered person in FORM GSTR-2B.( Rule 36(4)).

Currently, this limit is 105% of the eligible ITC appearing in the GSTR 2B.

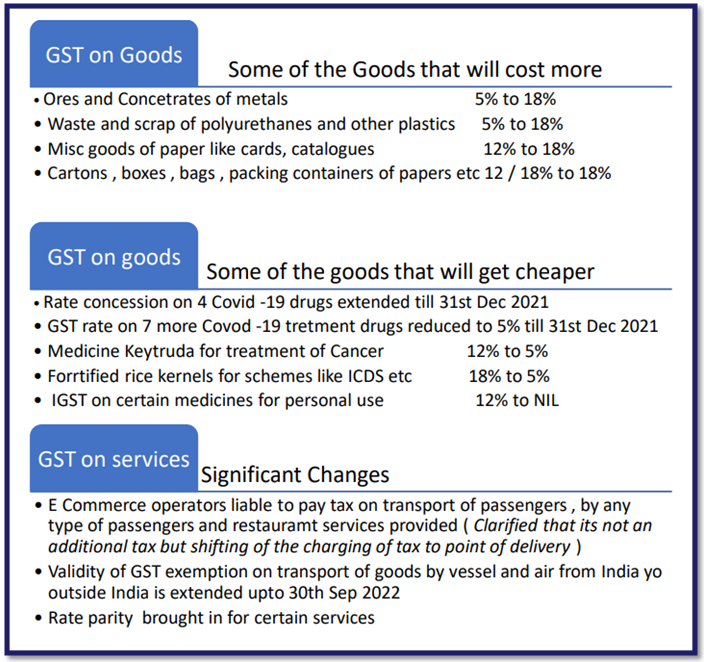

Rates of Tax on Goods and Services

GST Council has decided that it would not be the appropriate time to include petroleum products under GST. So this long-standing demand has been deferred.

GST rate changes to be effected on various goods and services

Having an expert GST Consultant in Kochi for your company will keep you informed about significant changes as well as provide necessary inputs for financial decision-making at the appropriate time.

For more information, please email vbvassoc@gmail.com or contact +91 980 901 2123.

English

English