TDS & TCS – 3 SECTIONS – MANY DIMENSIONS

HIGHER RATES OF TDS/TCS

Who Are Specified Persons?

Condition 1: Person has not filed their Income Tax Return for two previous years immediately preceding the previous year in which tax is required to be deducted/collected and the time limit for filing such return of income U/s 139(1) has expired.

Condition 2: Aggregate of Tax deducted/collected at source in each of these two financial years is INR 50,000/- or more (Excludes non-resident without a permanent establishment in India)

TDS SECTIONS NOT COVERED UNDER 206 (AB)

Section 192 – Salary

Section 192A – Payment of accumulated balance due to an employee

Section 194B – Winnings from lottery or crossword puzzle

Section 194BB – Winning from a horse race

Section 194LBC – Income in respect of investment in securitization trust

Section 194N – Payments of certain amounts/amounts in cash

FAQ 1

How would the deductor/ collector identify whether a deductee/ Collette has filed his ITR for the previous two years or not and whether his TDS/ TCS credit is equal to higher than 50,000/- or not?

ANSWER: CBDT has issued a Circular regarding the use of functionality under Section 206AB and 206CCA of the Income-tax Act, 1961 (as mentioned in Circular No. 11 of 2021dated 21st June,2021-) at the ( Reporting portal @ https://report.insight.gov.in).).

FAQ 2

The payee has not filed his return of income for the previous years 2018-19 and 2019-20 and the TDS / TCS for 2019-20 was Rs.60,000 whereas for 2018-19 it is 49,500/-. Would he be a specified person under the provisions?

ANSWER: No, Since the TDS / TCS for one previous year is less that 50,000/-, TDS shall be deducted at the normal rate

FAQ 3

An amount of payment of Rs.1,00,000/- is to be made for consultation services rendered vide invoice dated 3rd Dec 2021 to XYZ Ltd . XYZ Ltd had filed the ROI for the PY 2018-19 but not filed the ROI for PYs 2019-20 and 2020-21 and TDS for all these years exceeds 50,000/-Whether TDS needs to be deducted at a higher rate while accounting the invoice dated 3rd Dec 2021?

ANSWER: Yes, since the due date for filing for PY 2020-21 has expired. ( Assuming there are no further extensions).

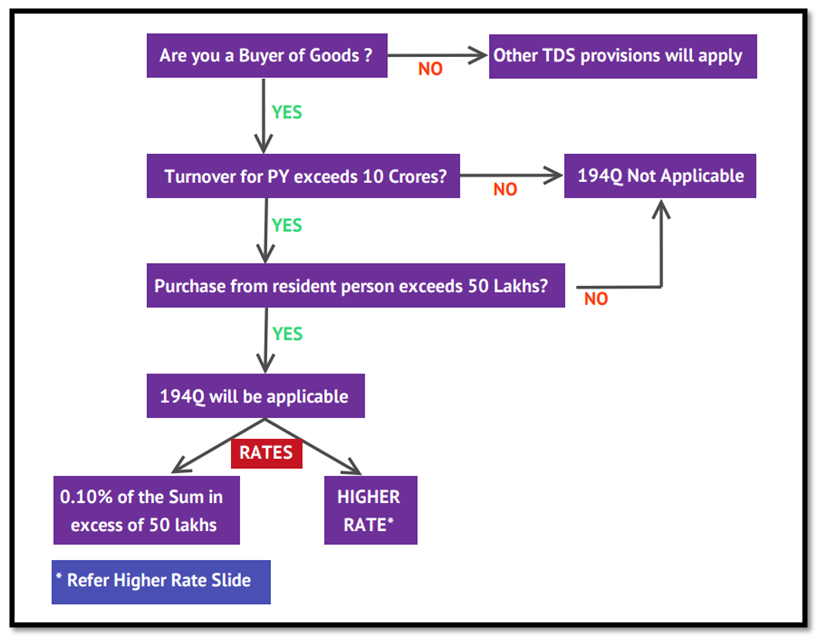

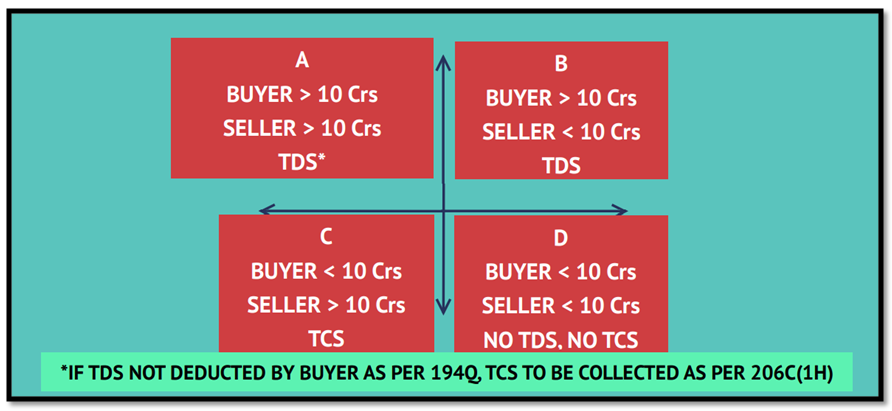

BUYER’S CHART

FAQ 4

ETCS makes an advance payment of Rs. 55 lakhs for purchase of goods on 30.6.2021, and debits such purchases in his books on 15.7.2021 upon receipt of goods. ETCS turnover from his business in FY 2020-21 was Rs.11 crores.. Should he deduct TDS on 15th July when he accounts for the invoice?

ANSWER: In this case, ETCS will not be liable to deduct TDS u/s 194Q on such purchases of Rs. 55 lakhs, paid before 1.7.2021, though debited after 1.7.2021. ( time of credit or payment whichever is earlier)

FAQ 5

As per the P & L of V & V Associates for the year ended 31st March 2021, the total income is Rs.10.80 crores which constitutes 9.80 crores from the sale of goods and Rs.1. crores interest from deposits. Would the provisions of TDS deduction u/s 194Q apply?

ANSWER: For calculation of the threshold limit total turnover from the business is to be considered and other income is to be excluded. Hence not applicable.

FAQ 6

M/s E E Ltd made a purchase of Rs.55 lakhs on 10th May 2021 from CDIX and settled the payment on 2nd July 2021. The next purchase was made on 18th July 2021 for Rs.45 lakhs. What is the amount of tax to be deducted by EE Ltd from CDIX assuming EE ltd had a turnover greater than 10 crores for the previous year?

ANSWER: TDS deductible shall be Rs.4,500/- (0.1% of Rs.45 lakhs)

FAQ 7

How would the purchase returns be considered for the purpose of deduction u/s 194Q? To illustrate, assuming that a purchase of 80 lakhs was made on 5th July 2021 and TDS was deducted from the payment made on the same date. The buyer made a return on 1st August 2021 from these purchases Rs.10 lakhs.

ANSWER: Initial TDS Rs.3,000/-; subsequently the amount of return would be adjusted against future payments and the excess TDS of Rs.1,000/- would be adjusted along with those future purchases. However, if goods are provided in replacement of the returns no adjustment for TDS is to be done.

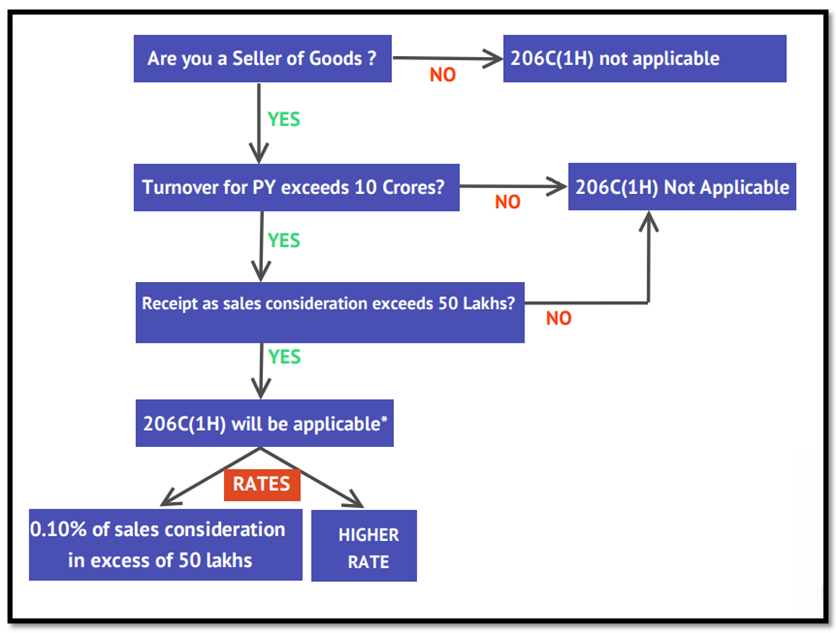

SELLER’S CHART

FAQ 8

Whether GST is to be included for the purpose of deduction of TDS from the amount of purchases under Section 194Q? Is it the same treatment for the collection of TCS by the seller on the sales made?

ANSWER: GST to be excluded for the purpose of deduction of TDS under section 194Q; however, for collection of TCS under section 206(1H) GST need not be deducted since the amount on which TCS is collected is sales consideration received

FAQ 9

A sale was made by TQ Ltd to its customer Mr. S on 25th May 2021 for Rs. 60 lakhs and the amount was received by TQ on 30th June 2021. Would he be liable to collect TCS? If yes on what amount and on which date?

ANSWER: Yes, TCS to be collected. On the amount in excess of Rs.50 lakhs i.e.10 lakhs @0.1% on 30th June 2021

FAQ 10

ABC Ltd has purchased goods from S & Co. worth Rs. 55 lakhs on 31.3.2021 and Rs. 50 lakhs on 1.7.2021, and S & Co has received payment of Rs. 65 lakhs on 15.7.2021, with respect to the two purchases made by ABC Ltd. The business turnover of both ABC Ltd (buyer) and S & Co. (seller)in FY 2020-21 was above 10 crores. Whether TDS has to be deducted by ABC Ltd u/s 194Q or TCS has to be collected by S & Co u/s 206C(1H) (assuming other conditions of section 194Q and section 206C(1H) are satisfied)?

ANSWER: The buyer has not crossed the threshold limit of Rs. 50 lakhs in FY 2021-22 and the seller has received the amount exceeding the threshold limit of Rs. 50 lakhs, on 15.7.2021, in FY 2021-22, the seller has to collect the tax (TCS) of Rs. 1500 @ 0.1% on Rs. 10 lakhs.

POINTS TO CONSIDER

1. Check applicability of 194Q (TDS) in case of purchases & 206C(1H) (TCS) in case of receipts – Obtain declaration to confirm.

2. Check if Counterparty is a “SPECIFIED PERSON” as per 206AB (TDS) / 206CCA (TCS) and charge applicable rates.- Obtain declaration to confirm till the time the Compliance Check functionality is active on the Income Tax portal.

3. The specified person shall not include a non-resident who does not have a permanent establishment in India.

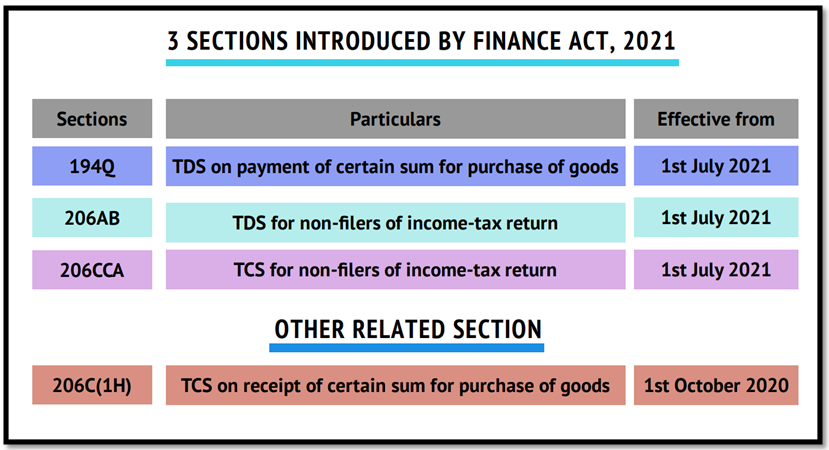

194Q- TDS on payment of a certain sum for the purchase of goods

(1) Any person, being a buyer who is responsible for paying any sum to any resident (hereafter in this section referred to as the seller) for purchase of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, shall, at the time of credit of such sum to the account of the seller or at the time of payment thereof by any mode, whichever is earlier, deduct an amount equal to 0.1 percent of such sum exceeding fifty lakh rupees as income tax.

Explanation.—For the purposes of this sub-section, “buyer” means a person whose total sales, gross receipts or turnover from the business carried on by him exceed ten crore rupees during the financial year immediately preceding the financial year in which the purchase of goods is carried out, not being a person, as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.

(2) Where any sum referred to in sub-section (1) is credited to any account, whether called “suspense account” or by any other name, in the books of account of the person liable to pay such income, such credit of income shall be deemed to be the credit of such income to the account of the payee and the provisions of this section shall apply accordingly.

(3) If any difficulty arises in giving effect to the provisions of this section, the Board may, with the previous approval of the Central Government, issue guidelines for the purpose of removing the difficulty.

(4) Every guideline issued by the Board under sub-section (3) shall, as soon as may be after it is issued, be laid before each House of Parliament, and shall be binding on the income-tax authorities and the person liable to deduct tax.

(5) The provisions of this section shall not apply to a transaction on which—

(a) tax is deductible under any of the provisions of this Act, and

(b) tax is collectible under the provisions of section 206C other than a transaction to which subsection (1H) of section 206C applies)

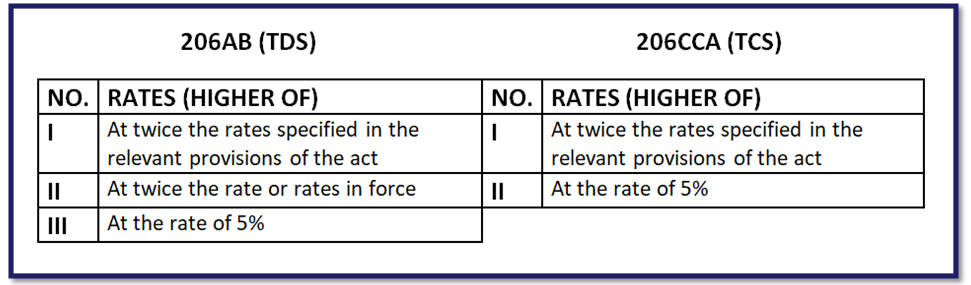

206AB – Special provision for deduction of tax at source for non-filers of income-tax return (TDS)

(1) Notwithstanding anything contained in any other provisions of this Act, where tax is required to be deducted at source under the provisions of Chapter XVIIB, other than section 192, 192A, 194B, 194BB, 194LBC, or 194N on any sum or income or the amount paid, or payable or credited, by a person (hereafter referred to as deductee) to a specified person, the tax shall be deducted at the higher of the following rates, namely:—

(i) at twice the rate specified in the relevant provision of the Act; or

(ii) at twice the rate or rates in force; or

(iii) at the rate of five percent.

(2) If the provisions of section 206AA are applicable to a specified person, in addition to the provision of this section, the tax shall be deducted at higher of the two rates provided in this section and in section 206AA.

(3) For the purposes of this section “specified person” means a person who has not filed the returns of income for both of the two assessment years relevant to the two previous years immediately prior to the previous year in which tax is required to be deducted, for which the time limit of filing return of income under sub-section (1) of section 139 has expired; and the aggregate of tax deducted at source and tax collected at source in his case is rupees fifty thousand or more in each of these two previous years:

Provided that the specified person shall not include a non-resident who does not have a permanent establishment in India. Explanation.—For the purposes of this subsection, the expression “permanent establishment” includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.]

206CCA – Special provision for collection of tax at source for non-filers of income-tax return (TCS)

(1) Notwithstanding anything contained in any other provisions of this Act, where tax is required to be collected at source under the provisions of Chapter XVII-BB, on any sum or amount received by a person (hereafter referred to as collectee) from a specified person, the tax shall be collected at the higher of the following two rates, namely:—

(i) at twice the rate specified in the relevant provision of the Act; or

(ii) at the rate of five percent.

(2) If the provisions of section 206CC are applicable to a specified person, in addition to the provisions of this section, the tax shall be collected at higher of the two rates provided in this section and in section 206CC.

(3) For the purposes of this section “specified person” means a person who has not filed the returns of income for both of the two assessment years relevant to the two previous years immediately prior to the previous year in which tax is required to be collected, for which the time limit of filing return of income under sub-section (1) of section 139 has expired; and the aggregate of tax deducted at source and tax collected at source in his case is rupees fifty thousand or more in each of these two previous years:

Provided that the specified person shall not include a non-resident who does not have a permanent establishment in India. Explanation.—For the purposes of this subsection, the expression “permanent establishment” includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.

206AA – Requirement to furnish Permanent Account Number (TDS)

(1) Notwithstanding anything contained in any other provisions of this Act, any person entitled to receive any sum or income or amount, on which tax is deductible under Chapter XVIIB (hereafter referred to as deductee) shall furnish his Permanent Account Number to the person responsible for deducting such tax (hereafter referred to as deductor), failing which tax shall be deducted at the higher of the following rates, namely:—

(i) at the rate specified in the relevant provision of this Act; or

(ii) at the rate or rates in force; or

(iii) at the rate of twenty percent

(2) No declaration under sub-section (1) or sub-section (1A) or sub-section (1C) of section 197A shall be valid unless the person furnishes his Permanent Account Number in such declaration.

(3) In case any declaration becomes invalid under sub-section (2), the deductor shall deduct the tax at source in accordance with the provisions of sub-section (1).

(4) No certificate under section 197 shall be granted unless the application made under that section contains the Permanent Account Number of the applicant.

(5) The deductee shall furnish his Permanent Account Number to the deductor and both shall indicate the same in all the correspondence, bills, vouchers, and other documents which are sent to each other.

(6) Where the Permanent Account Number provided to the deductor is invalid or does not belong to the deductee, it shall be deemed that the deductee has not furnished his Permanent Account Number to the deductor and the provisions of sub-section (1) shall apply accordingly.

(7) The provisions of this section shall not apply to a non-resident, not being a company, or to a foreign company, in respect of—

(i) payment of interest on long-term bonds as referred to in section 194LC; and

(ii) any other payment subject to such conditions as may be prescribed.

206CC – Requirement to furnish Permanent Account Number (TCS)

(1) Notwithstanding anything contained in any other provisions of this Act, any person paying any sum or amount, on which tax is collectible at source under Chapter XVII-BB (herein referred to as collectee) shall furnish his Permanent Account Number to the person responsible for collecting such tax (herein referred to as collector), failing which tax shall be collected at the higher of the following rates, namely:—

(i) at twice the rate specified in the relevant provision of this Act; or

(ii) at the rate of five percent.

(2) No declaration under sub-section (1A) of section 206C shall be valid unless the person furnishes his Permanent Account Number in such declaration.

(3) In case any declaration becomes invalid under sub-section (2), the collector shall collect the tax at source in accordance with the provisions of sub-section (1).

(4) No certificate under sub-section (9) of section 206C shall be granted unless the application made under that section contains the Permanent Account Number of the applicant.

(5) The collectee shall furnish his Permanent Account Number to the collector and both shall indicate the same in all the correspondence, bills, vouchers, and other documents which are sent to each other.

(6) Where the Permanent Account Number provided to the collector is invalid or does not belong to the collectee, it shall be deemed that the collectee has not furnished his Permanent Account Number to the collector and the provisions of sub-section (1) shall apply accordingly.

(7) The provisions of this section shall not apply to a non-resident who does not have a permanent establishment in India.

Explanation.—For the purposes of this subsection, the expression “permanent establishment” includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.

We, VBV & Associates, as one of the Income Tax Consultants in Kochi, are always happy to hear from you. Contact us at vbvassoc@gmail.com or call us at +91 980 901 2123 for further assistance.

English

English