Understanding Tax Brackets: How Marginal Tax Rates Impact Your Tax Liability

Ever wondered why you pay more tax as your income increases? It all comes down to tax brackets and marginal tax rates. Let’s break down these concepts and see how they impact your tax bill with the help of Tax Advisory Services Kochi, Kerala.

What Are Tax Brackets?

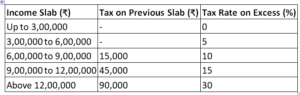

Tax brackets are ranges of income that are taxed at specific rates. In India, the Income Tax Department has established different tax slabs for different income levels. For the financial year 2023-24, the tax brackets for individual taxpayers below 60 years of age are as follows:

These rates apply to taxable income, which is your gross income minus any deductions and exemptions you are eligible for.

Understanding Marginal Tax Rates

The marginal tax rate is the rate of tax you pay on an additional rupee of income. This is different from your average tax rate, which is the total tax you pay divided by your total income.

For example, if your taxable income is ₹7 lakh, your income would fall into the 10% tax bracket. However, this does not mean you pay 10% on the entire ₹7 lakh. Instead, you pay:

- 0% on the first ₹3 lakh

- 5% on the next ₹3 lakh (₹3,00,001 to ₹6 lakh)

- 10% on the remaining ₹1 lakh (₹6,00,001 to ₹7 lakh)

How Marginal Tax Rates Impact Your Tax Liability

Understanding marginal tax rates is crucial because it affects your decisions regarding income, investments, and tax planning. Here’s a breakdown of how marginal tax rates influence your tax liability:

Incremental Income: If you receive a bonus or a raise, only the income that falls within a higher tax bracket will be taxed at the higher rate. For example, if your salary increases from ₹11.5 lakh to ₹12.5 lakh, only the ₹50,000 above ₹12 lakh will be taxed at 30%, while the rest will be taxed according to the lower brackets.

Tax Planning: Knowing your marginal tax rate helps in tax planning. For instance, if you’re on the cusp of a higher tax bracket, you might consider investing in tax-saving instruments like Public Provident Fund (PPF), National Savings Certificates (NSC), or tax-saving fixed deposits to reduce your taxable income and stay within a lower tax bracket.

Deductions and Exemptions: Utilize deductions under Section 80C, 80D and other sections to reduce your taxable income. For example, investments up to ₹1.5 lakh in PPF, ELSS, or life insurance premiums are deductible under Section 80C. Health insurance premiums under Section 80D can also provide substantial tax benefits.

E.g. Let’s consider an individual, Alex, with a taxable income of ₹13 lakh. Here’s how his tax liability would be calculated:

- First ₹3 lakh: No tax

- Next ₹3 lakh (₹3,00,001 to ₹6 lakh): 5% of ₹3 lakh = ₹15,000

- Next ₹3 lakh (₹6,00,001 to ₹9 lakh): 10% of ₹3 lakh = ₹30,000

- Next ₹3 lakh (₹9,00,001 to ₹12 lakh): 15% of ₹3 lakh = ₹45,000

- Remaining ₹1 lakh (₹12,00,001 to ₹13 lakh): 30% of ₹1 lakh = ₹30,000

Total tax liability = ₹0 + ₹15,000 + ₹30,000 + ₹45,000 + ₹30,000 = ₹1,20,000

Understanding tax brackets and marginal tax rates is essential for effective tax planning and ensuring that you maximize your take-home pay. By being aware of how these rates apply to your income, you can make informed decisions about investments, savings, and other financial strategies to minimize your tax liability. Always consult with a Tax Consultants in Kochi or financial advisor to tailor these strategies to your specific financial situation and goals.

English

English